Apple Pay Later, we hardly knew ye. Apple has announced that it is putting an end to its Apple Pay Later program. Apple launched the short-term financing solution less than a year ago.

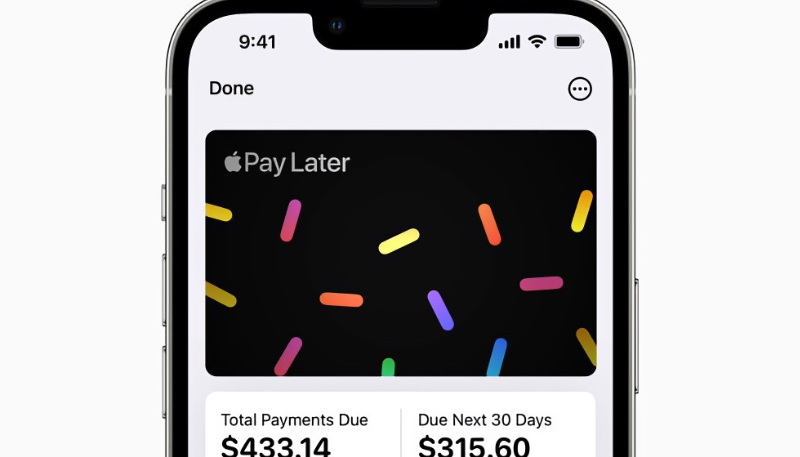

Apple Pay Later was first announced at WWDC 2022 and is a “buy now, pay later” financing option that allows qualifying U.S. customers to split an Apple Pay purchase into four equal payments spread over six weeks, with no interest or fees. Users need to apply for Apple Pay Later loans of $75 to $1,000, which they can then use to make online and in-app purchases with Apple Pay on the iPhone and iPad.

The program was officially launched in October 2023.

While the program has reportedly been successful, the tech giant is killing off the program in favor of new options to be launched later this year.

Apple told 9to5Mac that the company would instead be working with existing short-term loan programs, such as Affirm, to integrate them into Apple Pay.

While Goldman Sachs issued the Mastercard payment credential for the program, Apple Pay Later loans were actually financed by the iPhone maker itself.

If you still have an active Apple Pay Later loan you can still manage and pay those loans via the Wallet app. Apple hardware installment plans are unaffected by the end of Apple Pay Later.

Earlier this month, Apple announced that new Apple Pay features would be rolling out in the fall. The announcement hinted that Apple may be ending the short-term loan service.

Apple Pay introduces even more flexibility and choice for users when they check out online and in-app. Users can view and redeem rewards, and access installment loan offerings from eligible credit or debit cards, when making a purchase online or in-app with iPhone and iPad. These features will be available for any Apple Pay-enabled bank or issuer to integrate in supported markets.

The announcement also said Apple Pay users will also be able to apply for pay-later loans directly through Affirm when using Apple Pay to check out.

(Via MacRumors)