Apple has officially launched Apple Pay Later for all qualified U.S. residents. The feature had been available only on an invite-only “early access” basis since March.

Apple removed the following sentence from all Apple Pay Later support documents today:

Apple Pay Later is currently only available to customers invited to access a prerelease version.

Apple Pay Later was first announced at WWDC 2022 and is a “buy now, pay later” financing option that allows qualifying U.S. customers to split an Apple Pay purchase into four equal payments spread over six weeks, with no interest or fees. Users need to apply for Apple Pay Later loans of $75 to $1,000, which they can then use to make online and in-app purchases with Apple Pay on the iPhone and iPad.

Users can apply for an Apple Pay Later loan in the Wallet app without impacting their credit. Users simply enter the amount they’d like to borrow, agree to the Apple Pay Later terms, and wait for a soft credit check to be performed. Once approved, the user will see Apple Pay Later become available as an option in Apple Pay.

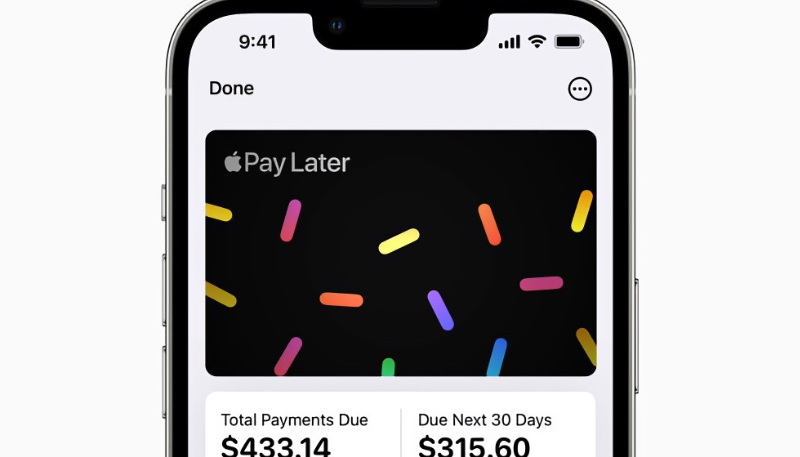

Users can access Apple Pay Later in the Wallet app on the iPhone, where they can view, track, and manage their loans in one place. Upcoming payments can be viewed on a calendar, and upcoming payment notifications can be received via email and the Wallet app. Payments are made via a linked debit card, and credit cards cannot be used to make payments.

Apple Financing LLC, a subsidiary of Apple, is handling all credit assessment and lending. The Apple Pay Later program is based on the Mastercard Installments program, so merchants that accept Apple Pay are ready to accept it with no special implementation.