Apple announced today that Apple Card holders have deposited over $10 billion in Apple Card Savings accounts offered by Goldman Sachs. The milestone takes place just four months after the feature launched (in April).

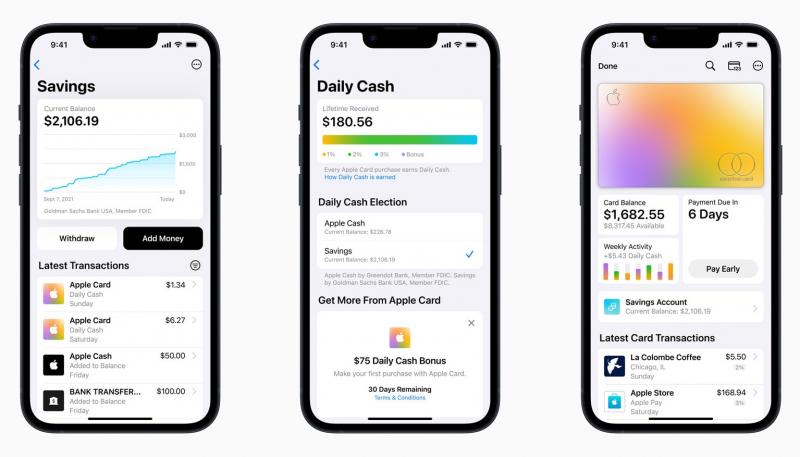

Apple says that 97% of Savings customers have opted in to having their Apple Card Daily Cash automatically deposited into a savings account, which currently offers a 4.15 APY.

“With each of the financial products we’ve introduced, we’ve sought to reinvent the category with our users’ financial health in mind. That was our goal with the launch of Apple Card four years ago, and it remained our guiding principle with the launch of Savings,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “With no fees, no minimum deposits, and no minimum balance requirements, Savings provides an easy way for users to save money every day, and we’re thrilled to see the excellent reception from customers both new and existing.”

In a statement, Goldman Sachs’s Head of Enterprise Partnerships said that the company is “very pleased” with the Savings account’s success.

“We are very pleased with the success of the Savings account as we continue to deliver seamless, valuable products to Apple Card customers, with a shared focus on creating a best-in-class customer experience that helps consumers lead healthier financial lives,” said Liz Martin, Goldman Sachs’s head of Enterprise Partnerships.

The amount deposited becomes truly impressive when you consider the savings accounts are limited to iPhone users located in the United States.

The news comes in the wake of reports that Goldman Sachs is looking to pull out of its Apple Card partnership with Apple. Goldman Sachs has acted as the financing partner for the Apple Card credit card in the United States, Apple Pay Later, and the Apple Savings account that Apple Card users can open.

The financial firm is in discussions with American Express about taking over its Apple-related operations, said a report from The New York Times. Goldman Sachs reportedly wants to abandon the deal because it is not making enough money and it has had trouble dealing with customer service issues.

Goldman Sachs was hit by more disputed transactions than it had expected, thanks to customers seeking chargebacks for products and services. Chargebacks occur when a customer seeks a refund for a product or service billed on their card for any of a number of reasons. such disputes have surged during the pandemic, say payments consultants.

Goldman Sachs was unprepared for the long queues that needed to be cleared. The company lacked a streamlined process in place for resolving customer complaints.