The head of the US Consumer Financial Protection Bureau (CFPB) says the agency will take a “very careful look” at Apple Pay Later and similar offerings by other Big Tech firms entering the “buy now, pay later” (BNPL) lending business, due to antitrust concerns.

CFPB is already examining the BNPL market, with five existing players all now required to submit detailed information to the agency. CFPB director Rohit Chopra, says that the regulator will also “have to take a very careful look [at] the implications of Big Tech entering this space.”

Chopra said that the entry of any Big Tech firm into short-term lending “raises a host of issues,” specifically the customer data that gets gathered.

“Is it being combined with browsing history, geolocation history, health data, other apps?” he said. “Big Tech’s ambitions when it comes to “buy now, pay later” are inextricably linked to the desire to dominate the digital wallet.”

“Any tech giant that has a lot of control over a mobile operating system is going to have unique advantages to exploit data and e-commerce more broadly,” he continued. Any such firm will keep pushing further into financial services, “to gain even deeper insights on consumer behavior.”

Chopra says he has concerns that these services will “intrusively” gain an “extraordinary window” into consumer behavior.

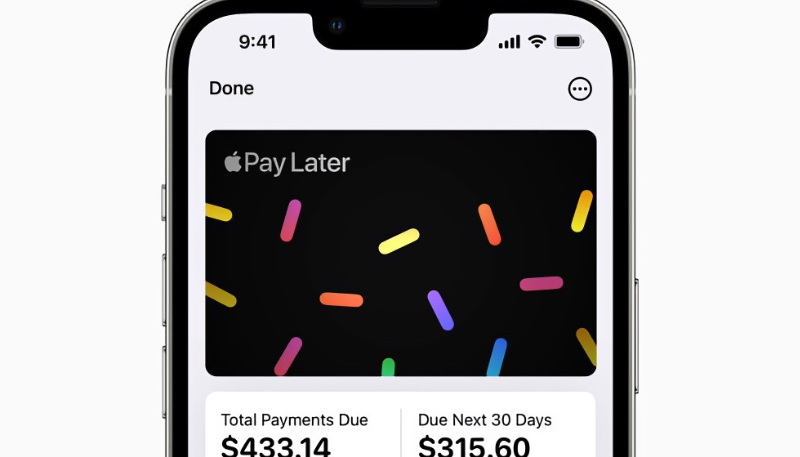

Apple Pay Later allows users to split the cost of a transaction into four payments over six weeks.