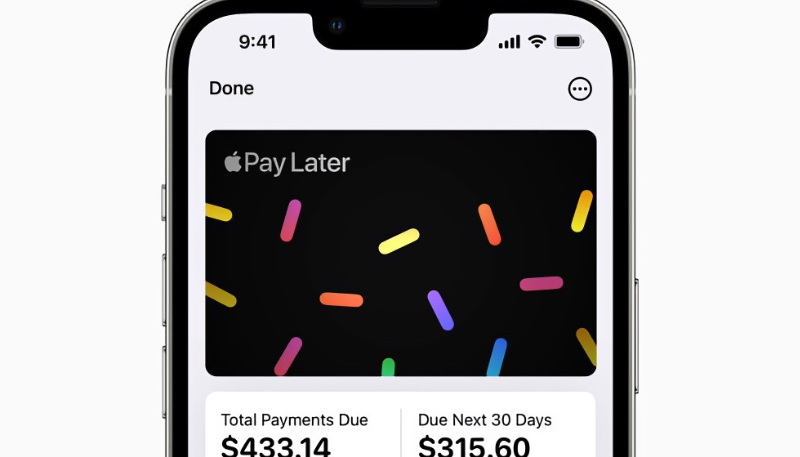

Apple will carry the debt for its new “Apple Pay Later” service that allows users to purchase items and split the cost into four payments over six weeks.

To power the service, Apple has established a wholly-owned subsidiary. “Apple Financing LLC,” has obtained state lending licenses and will operate independently from the main corporate entity to back the newly announced Apple Pay Later service.

As noted by Bloomberg, this marks the first time Apple is handling key financial tasks like loans, risk management, and credit assessments. Until now, Apple’s financial services have been backed by third-party credit processors and banks. The Apple Card credit card, for example, uses Goldman Sachs Group Inc. for lending and credit assessment.

The report says Apple’s Apple Pay Later service is just one financial service of many that Apple has been moving under the Apple brand “as part of a ‘secret initiative'” the company internally calls “Breakout.” Apple is also expected to self-finance its much-rumored device subscription program that will allow users to pay for new devices and services over smaller monthly installments.