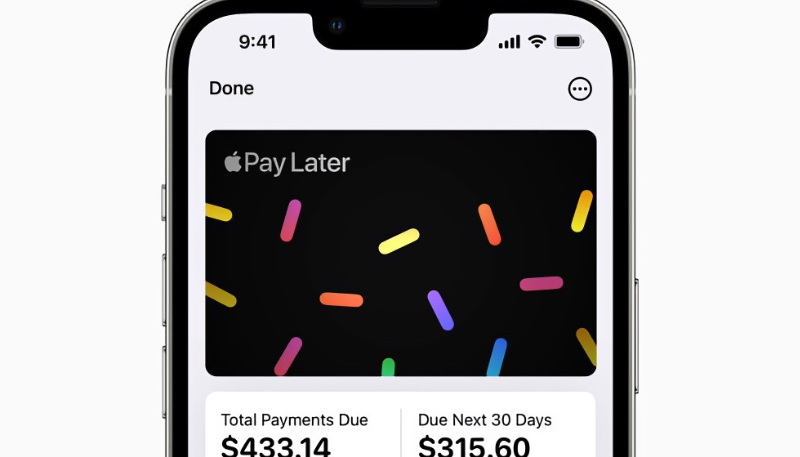

Later this fall, Apple Pay Later will begin allowing customers in the United States to pay for online and in-app purchases over a six-week installment plan with no interest or fees. The new feature was previewed during the WWDC 2022 keynote.

Apple Pay Later will let customers split a purchase into four equal payments paid over the course of six weeks. Apple Pay Later will include zero interest and no fees and will be available “everywhere Apple Pay is accepted,” according to Apple.

In what has become a bit of a tradition, a current player in an Apple-target industry says they are not worried about Apple’s entry into their space. They usually say this as they’re looking for the key to lock up their offices for the last time.

As reported by iMore, Affirm CEO Max Levchin says that he isn’t worried that Apple’s upcoming buy now, pay later feature will impact his own business.

In an interview with Bloomberg, Levchin said that he believes his own company still has plenty of room to grow, even with Apple Pay Later’s entry into the space.

“I don’t think there’s much concern,” Levchin said Tuesday in an interview on Bloomberg Television. “There’s a lot of room for growth for all involved.” Buy now, pay later is used for fewer than 5% of US transactions, he said.

Affirm does admittedly offer more credit options (from six weeks to five years). Levchin says he believes that Apple’s entry into the pay later market is good for his company. Sort of a “rising tide lifts all ships” scenario. He says it creates a “tailwind” that will help make customers aware that paying later is an option. Customers that will want to pay over a longer period will choose Affirm over Apple Pay.

Klarna CEO Sebastian Siemiatkowski believes the same thing, noting that “plagiarism is also the highest form of flattery,” and that Apple’s entry is a win for customers.

Apple’s new pay later surface will not be available until this fall, as it is part of Apple’s upcoming iOS 16 iPhone operating system.